Group Management Profile

Select’s Group Management are responsible for the day-to-day operations of the company and for establishing and implementing effective internal controls and risk management procedures to ensure that the businesses are conducted in a responsible manner.

The various departments of Group Management also provide technical assistance and specialized knowledge to the operations in the various countries of operation.

Sean O’Sullivan

Group Chief Executive Officer

B Com Honours, MBA Sean joined the Group in 2010. Prior to joining, Sean was the Head of Sales and Marketing at First National Bank’s home loans division for 3 years, responsible for the development and management of the retail mortgage lending book and the affordable housing sector in South Africa.Prior to joining First National Bank, Sean pursued his own interests and was CEO of Iquad Treasury Ltd for 15 years. Iquad is a risk management company with specific focus on both interest rate and currency management for large national and multi-national corporate companies. As part of Sean’s exit plan, he listed Iquad on the Johannesburg Stock Exchange.

Shane Leas – CA (SA)

Chief Executive Officer

The company benefits greatly from Shane’s extensive experience and knowledge. He holds a BCom (Hons) in Accounting and is a registered member of the South African Institute of Chartered Accountants. He joined the Group in June 2021.

Prior to joining Select Advisors, Shane held the role of Group Financial Manager at Sun International Limited where he was responsible for managing the full financial function of the listed group. His responsibilities included the preparation of complex Consolidated Annual Financial Statements, managing the group’s central Treasury and Tax function, managing deadlines on various deliverables, forecasting, budgeting, presenting reports to the Audit Committee, providing feedback to JSE Analysts, implementing new IFRS accounting standards and more. He also served as Chairman of the group’s Technical Accounting Committee and was part of the team that navigated a “Covid-19 business restructure” and successfully executed various merger and acquisition locally and internationally as well as disposing of non-core investments and implementing a shared service model across the group. He is committed to bringing his wealth of experience to Select Africa and ensuring the financial stability of the company in the long term.

Wayne Faulds

Group Executive – Business Expansion

Oxford Brooks accredited MBA, Diplomas in Marketing Management, International Treasury Management and Banking Regulation. Prior to joining Select Group in 2008, Wayne held the position of Divisional General Manager for UTi Group’s banking logistics division which focused on the distribution of credit/debit and transactional cards and cheque books. Prior to joining UTi, Wayne gained 20 years of experience in banking and microfinance as, amongst others, a dual General Manager of Non-Mortgage Housing and Customer Care with the Unifer Group (a microfinance provider in South Africa).

Anusha Naidu – CA (SA)

Corporate Finance

Anusha heads up Corporate Finance, including capital raising, structuring and investor relations at Select Africa, a pan African housing-focused microfinance institution. She is a South African Chartered Accountant with specialist financial services experience across local and international capital markets. Prior to joining Select in 2016, Anusha worked at various PricewaterhouseCoopers (“PwC”) global offices. She spent three years in PwC’s Banking and Capital Markets audit team in Johannesburg, where she led external audits on Standard Bank Group and FirstRand Treasury, as well as a four-month secondment to PwC Dubai. She also spent three years in PwC’s M&A Advisory team in London, where she led various buy-side and sell-side transactions for financial services clients, including private equity, hedge funds, investment banks, and retail banks. On her return to South Africa in 2015, she independently consulted to Old Mutual Investment Group in Cape Town for 6 months. Anusha is a guest lecturer on the University of Cape Town’s Department of Construction Economics & Management Property Portfolio Management, Property Finance and Investment programme and the Master of Commerce in Development Finance.

Theo van Rooyen

Chief Operating Officer: Retail

Prior to joining, Theo held the role of Area Manager at Finbond Mutual Bank where he was responsible for managing the total operational function of all branches in Gauteng. Theo has extensive Africa experience within Microfinance gained during his tenure at Blue Financial Services where he worked in countries such as Nigeria, Kenya, Tanzania, Rwanda and Namibia.Theo holds a Bachelor of Commerce Degree in Banking and Economics.

Bheki Dlamini

Chief Executive Officer: Eswatini

Bheki has been with Select for over 15 years and has risen through the ranks on the back of consistent performances in the various portfolio’s he previously occupied, which has enabled him to gain vast experience in the microfinance industry. Prior being promoted to CEO, Bheki held the role of General Manager where he was responsible for the overall operational excellence, which include operational oversite, performance management, operational result analysis and oversite in the execution of company strategy. Bheki holds an Association of Accounting Technicians (AAT) qualification.

Completed a Senior Management Development Programme (SMDP).

Akuzike Kafwamba

Chief Executive Officer: Malawi

Akuzike, a seasoned executive with a proven track record of driving growth, innovation, and financial inclusion. With an MBA in International Business from Amity University, a Bachelor of Arts in Humanities from the University of Malawi, and a Professional Leadership Certificate from Stellenbosch University, Akuzike possesses a unique blend of strategic leadership, investment management, and financial expertise. Prior to joining, Akuzike served as Country Manager for Business Partners International, leading investment transactions across Malawi, Rwanda, Uganda, Kenya, and Namibia, which equipped him with a deep understanding of the financial landscape in Africa.

Seabata Ntelo

Chief Executive Officer for Lesana Lesotho Limited

Seabata joins the Lesotho based team and brings with him over twenty years of experience in financial services both in Lesotho and working with company subsidiaries in various other countries across the continent.

Seabata was previously Chief Operating Officer at Nedbank Lesotho where he was responsible for the bank’s overall performance in line with the strategy and for supporting theManaging Director with the establishment and optimisation of the bank’s operations.

Prior to this, Seabata had a fourteen year career at the Central Bank of Lesotho (“CBL”) where he ultimately held the role of Director of Operations.

Some key achievements for Seabata include the following:

- He was nominated as part of a team of Consultants commissioned by the Macroeconomic & Financial Management Institute of Eastern & Southern African (MEFMI) to undertake an extensive Impact & Needs Assessment Study on MEFMI member countries.

- He was instrumental in the establishment of the National Payment System of the CBL.

- While at the CBL, he was involved in developing the regulations currently being used to regulate financial institutions in Lesotho, including Microfinance Institutions.

Seabata holds a Master of Arts Degree in Accounting & Finance, a Bachelor of Commerce Degree in Accounting and has completed a Senior Management Development Programme.

Vincent Kiyingi

Chief Executive Officer: Uganda

Vincent is a seasoned financial business executive with over 18 years of experience spanning banking, investment, and the financial sector across African markets. Prior to his current role, he served as Country Manager at Business Partners International–Uganda, a leading private equity fund headquartered in South Africa, where he led strategic investments in SME financing.

Earlier in his career, Vincent held several leadership positions within both regional and international banks. His roles included Head of SME Banking, and Group Head Business at Orient Bank (now I&M Bank), as well as Branch Manager, and Relationship Manager at Bank of Africa-Uganda. He was also a pioneer of the Direct Sales Team at Barclays Bank (now Absa Bank), where he served as Sales Manager and Direct Sales Representative.

Vincent holds an MBA from the University of South Wales (UK) and a BSc in Accounting and Finance (Hons) from Kyambogo University. He has further enhanced his expertise through executive programs, including an Executive Diploma in Strategic Change Management and a Postgraduate Certificate in AI in Business from Cambridge International Qualifications (UK), as well as a Certificate in Leadership Principles and Practices from Stellenbosch University.

He is also a certified Business Development Professional (BDP), accredited by the Global Business Development Professional Association (GBDA). Vincent’s dynamic leadership background and experience spanning retail and SME banking, as well as private equity sector has equipped him with deep industry insights and robust leadership competencies, driving sustainable business growth.

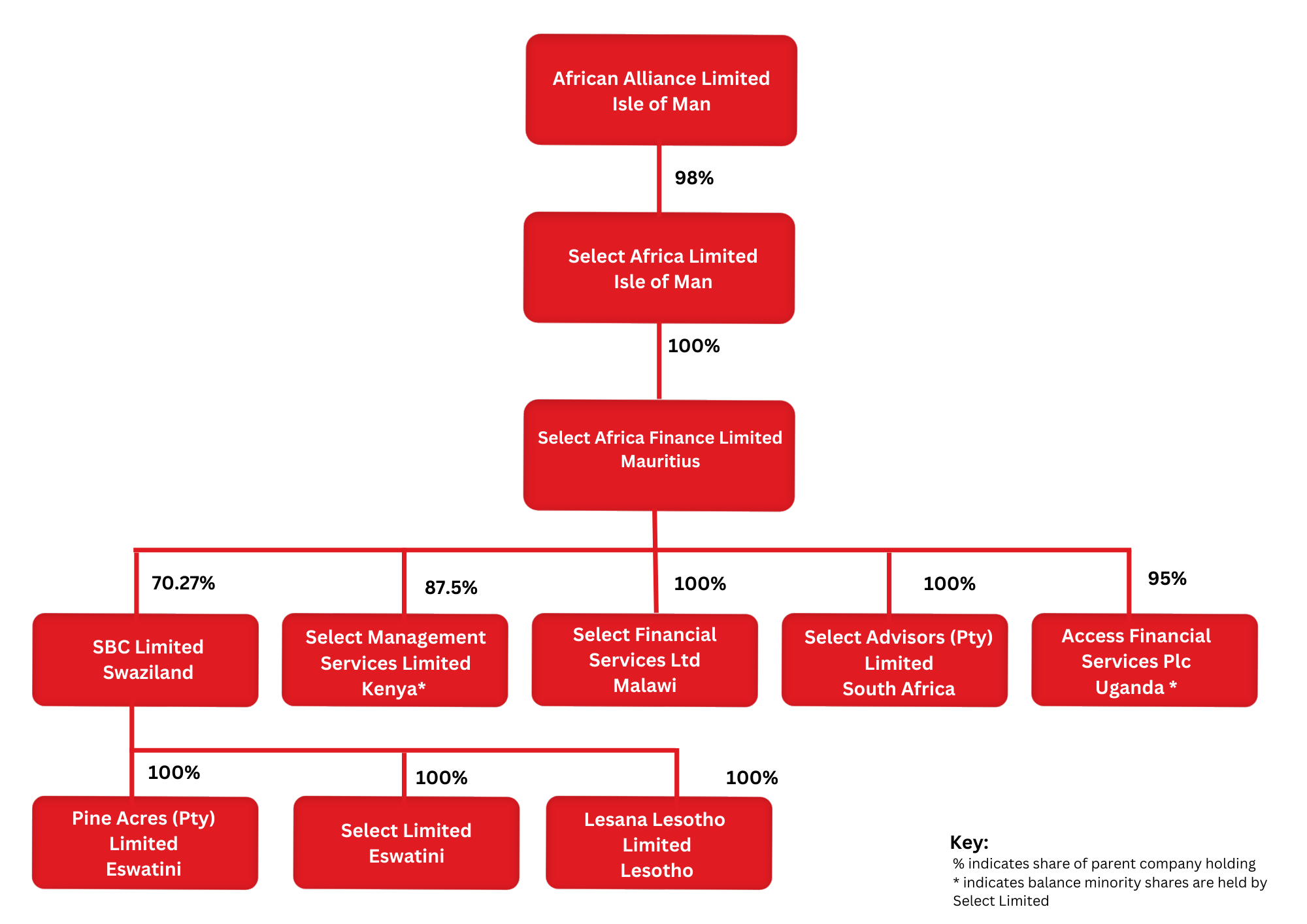

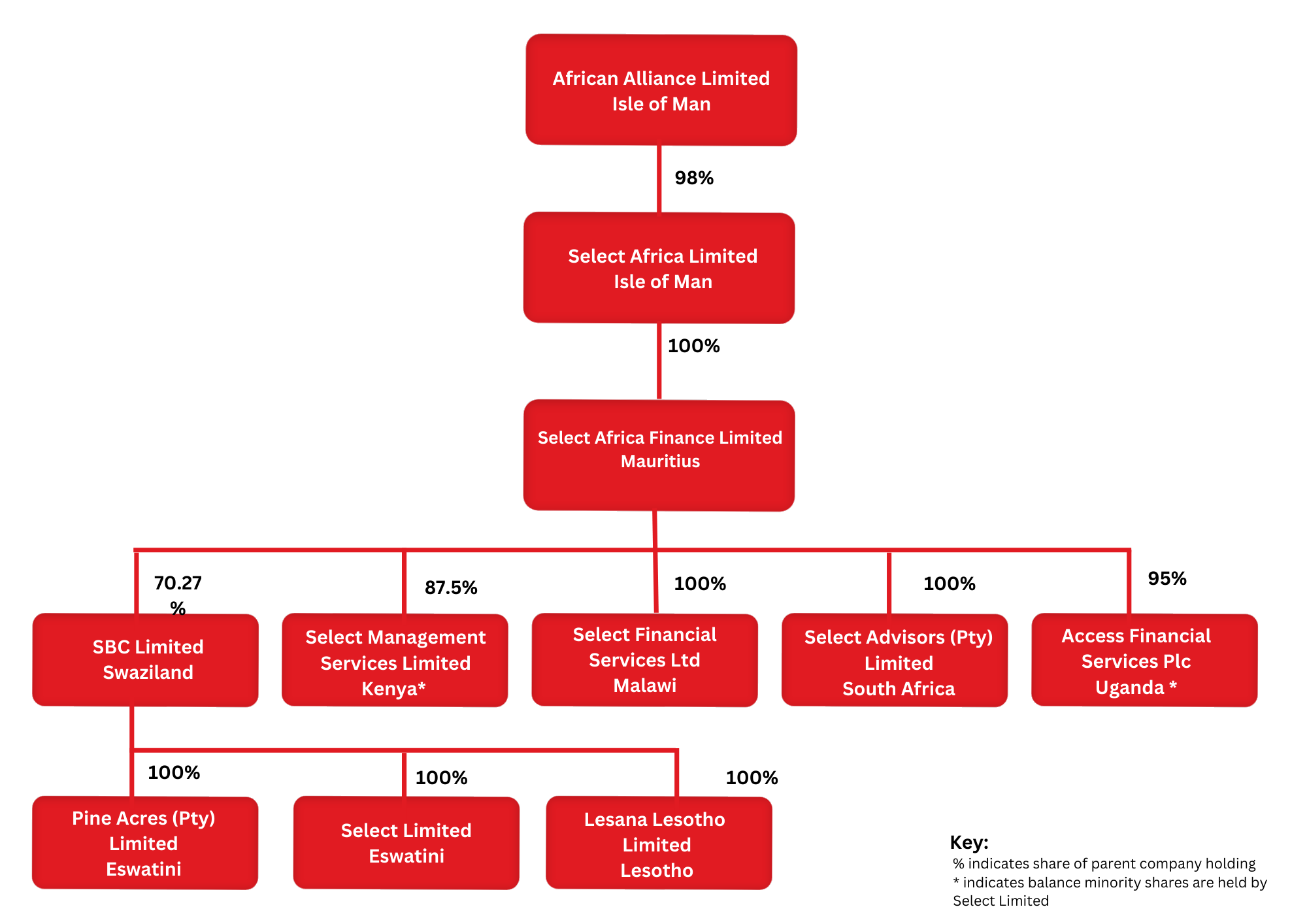

Organogram